- Community

-

Programs

- Schools

-

Careers

- RN Specialties

- Best RN Jobs and Salaries

- Aesthetic Nurse

- Nursing Informatics

- Nurse Case Manager

- NICU Nurse

- Forensic Nurse

- Labor and Delivery Nurse

- Psychiatric Nurse

- Pediatric Nurse

- Travel Nurse

- Telemetry Nurse

- Dermatology Nurse

- Nurse Practitioner

- Best NP Jobs and Salaries

- Family NP (FNP)

- Pediatric NP

- Neonatal NP

- Oncology NP

- Acute Care NP

- Aesthetic NP

- Women's Health NP

- Adult-Gerontology NP

- Orthopedic NP

- Emergency NP

- Psychiatric-Mental Health NP (PMHNP)

- APRN

- Nurse Educator

- Nurse Administrator

- Certified Nurse Midwife (CNM)

- Clinical Nurse Specialist (CNS)

- Certified Registered Nurse Anesthetist (CRNA)

- Resources

- Education

psychnp179

39 Posts

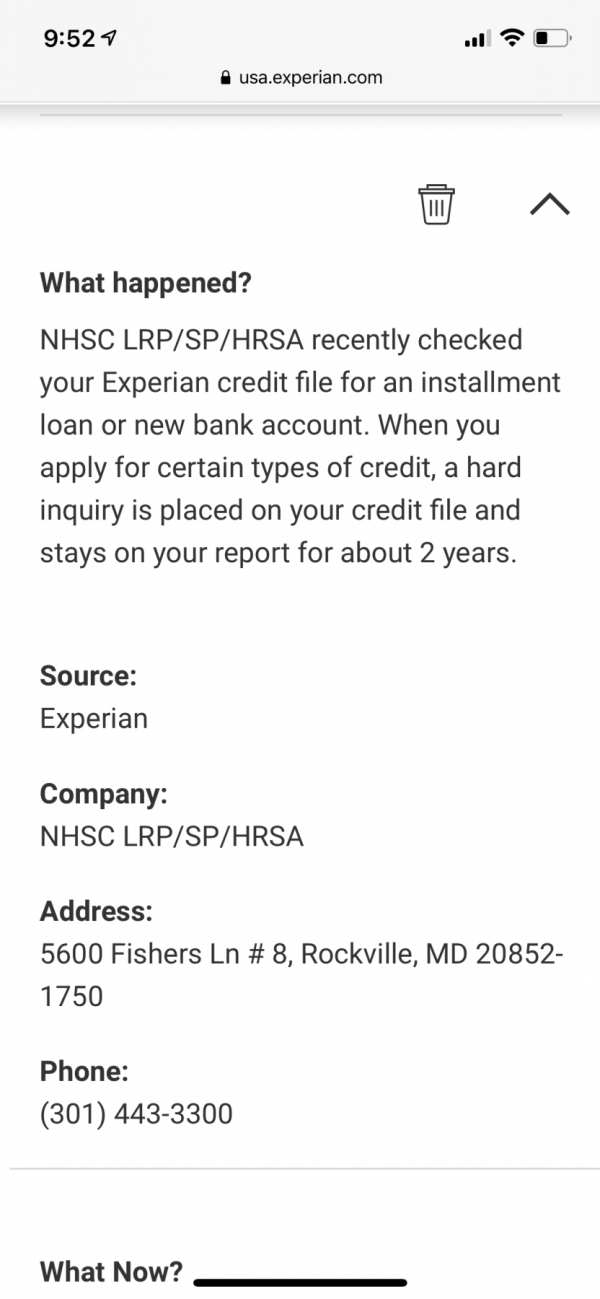

Thanks to Chocoholic1 for this comment: "Does anyone know if the new bill that makes federal loan pardoning tax-exempt will impact the nurse corp loan repayment program? Does anyone who has qualified in the past have any tips for filing taxes so that its clear that it isn't technically income? "

Ummm, I read the news A LOT and completely missed that the COVID relief bill included a piece that makes federal student loan forgiveness tax free until the end of 2025. That is HUGE and despite no news articles about this and the how it would benefit those receiving nursecorps loan repayment, it sure seems it would benefit those of us who may end up receiving the nursecorps loan repayment which traditionally is taxable. Here's an article about it:

https://www.studentloanplanner.com/tax-free-student-loan-forgiveness-american-rescue-plan/