- Community

-

Programs

- Schools

-

Careers

- RN Specialties

- Best RN Jobs and Salaries

- Aesthetic Nurse

- Nursing Informatics

- Nurse Case Manager

- NICU Nurse

- Forensic Nurse

- Labor and Delivery Nurse

- Psychiatric Nurse

- Pediatric Nurse

- Travel Nurse

- Telemetry Nurse

- Dermatology Nurse

- Nurse Practitioner

- Best NP Jobs and Salaries

- Family NP (FNP)

- Pediatric NP

- Neonatal NP

- Oncology NP

- Acute Care NP

- Aesthetic NP

- Women's Health NP

- Adult-Gerontology NP

- Orthopedic NP

- Emergency NP

- Psychiatric-Mental Health NP (PMHNP)

- APRN

- Nurse Educator

- Nurse Administrator

- Certified Nurse Midwife (CNM)

- Clinical Nurse Specialist (CNS)

- Certified Registered Nurse Anesthetist (CRNA)

- Resources

- Education

zack1a

32 Posts

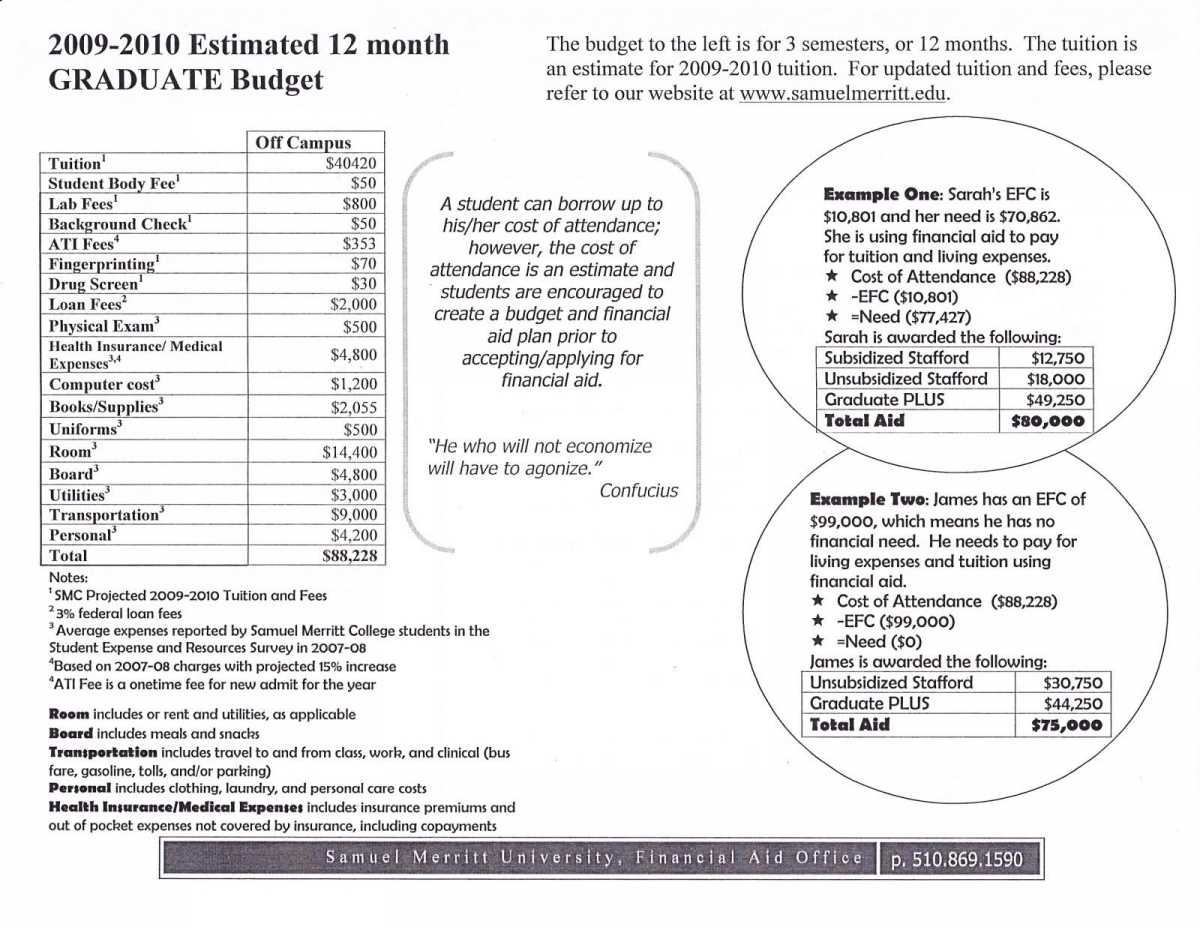

I am trying to sock away as much money as I can while I'm still able to work and would like some insight on what I'm looking at.

I am interested in an actual student's account of how much their program is costing them. I'm talking books, tuition, room & board, living expenses, ect. Just as close to an all-inclusive price as you can get for your situation. Please list your school when posting as well.

Thanks,

Zack